Empower your business with seamless operations through our instant capital solutions for POS Agents. At our platform, we offer weekly business capital of up to N200,000 ensuring that you have the financial support you need to run your business smoothly and efficiently. Experience the ease of access and flexibility in managing your capital needs with us.

Small Business Financing

Easy Application

Risk free Capital

We empower POS Agents to comply with anti-money laundering laws by providing them with weekly capital ranging from N30,000 to N200,000. Our financial support is tailored to help agents mitigate risks associated with money laundering, ensuring a secure and compliant business environment.

Low Interest Rate

Unlock financial flexibility with our POS financing featuring a low interest rate of just 2% per week. At our platform, we are committed to offering POS agents a competitive interest rate on the capital provided, ensuring a cost-effective solution for your business needs.

Duration

Crowcap brings you a unique 7-day capital funding crafted exclusively for POS agents and terminal owners. Our approach ensures that you receive capital precisely when your business demands it, with all funds valid for a dedicated 7-day period.

Business Support

Our platform offers continuous support to our agents, guiding them on how to effectively run their businesses and maximize profits. We believe in empowering our agents with the latest and most relevant information, ensuring they stay informed and equipped for success.

Dedicated Officer

At Crowcap, every agent receiving capital is paired with a dedicated account officer. This personalized touch ensures that your assigned officer manages all your requests and oversees the processing of your transactions.

We’re  changing the way micro businesses

changing the way micro businesses  are accessing funds

are accessing funds  and doing business in the sub-Saharan region. Helping more and more people to access

and doing business in the sub-Saharan region. Helping more and more people to access  Neo-Banking solution through

Neo-Banking solution through  capital financing for POS agents.

capital financing for POS agents.

Frequently asked questions

Do I need to have a POS Terminal to apply?

No, you don’t have to own a POS terminal. We also provide POS terminal to agent who already have a suitable location on instalment repayment plan.

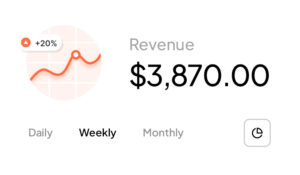

How much capital can I get weekly?

As a starter, we begin with N30,000 on weekly basis. Your financing level is reviewed over time to increased the capital you have access and could reach up to N200,000 weekly.

How do I know when to pay?

What is the interest rate?

We are not a loan company, hence we don’t ask for interest. We only request for a return on the investment made in your POS business. Our RoI rate is 2% weekly and is a flat rate.

Do I need a guarantor?

Yes, every agent must have a guarantor for the purpose of keeping track of the POS Agent not to default on their repayment. The financial strength of your guarantor also determines how much capital you can access.